In today’s increasingly complex financial landscape, navigating the world of investing can be a daunting task. With a plethora of investment options available, each with its own risks and rewards, making informed decisions can be challenging, especially for those without extensive financial expertise. This is where robo-advisors like Indexa Capital come into play, offering a simplified and automated approach to investing that empowers individuals to achieve their financial goals without the need for in-depth financial knowledge.

Indexa Capital: A Pioneer in Robo-Advising

Indexa Capital is a Spanish robo-advisor founded in 2015 with the mission to democratize access to low-cost, globally diversified investment portfolios. The firm has since expanded its reach across Europe, establishing a presence in Belgium and France. Indexa Capital’s philosophy is centered on the belief that passive investing, through index funds, can provide investors with superior long-term returns compared to traditional active management strategies.

A Data-Driven Approach to Investment Management

At the heart of Indexa Capital’s success lies its data-driven approach to investment management. The firm leverages sophisticated algorithms and extensive historical market data to create personalized investment portfolios tailored to each investor’s risk tolerance and financial goals. This data-driven approach ensures that Indexa Capital’s portfolios remain optimized and aligned with current market conditions.

Simplicity and Transparency: The Cornerstones of Indexa Capital

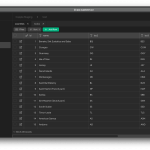

Indexa Capital’s platform is designed with simplicity and transparency in mind. Users can easily open an account, create a personalized investment plan, and monitor their portfolio performance, all through a user-friendly online interface. The firm also provides clear and concise explanations of investment terminology and concepts, empowering investors to make informed decisions.

Benefits of Investing with Indexa Capital

Investing with Indexa Capital offers a multitude of benefits, including:

Low fees: Indexa Capital charges some of the lowest fees in the robo-advisory industry, ensuring that investors retain a greater portion of their returns.

Diversification: Indexa Capital’s portfolios are globally diversified, investing in a variety of asset classes across different regions and industries. This diversification helps to mitigate risk and enhance potential returns.

Passive investing: Indexa Capital’s portfolios are built using index funds, which passively track market indices rather than attempting to outperform them. This passive approach has historically outperformed active management strategies in the long run.

Automated rebalancing: Indexa Capital automatically rebalances its portfolios periodically to ensure they remain aligned with each investor’s risk tolerance and financial goals.

Examples of Indexa Capital’s Success

Indexa Capital has a proven track record of success, consistently generating positive returns for its investors. For example, the firm’s flagship portfolio, Indexa Cartera 10, has achieved an average annual return of 7.3% since its inception in 2015. This compares favorably to the average annual return of 5.5% for the MSCI World index during the same period.

Indexa Capital: A Trusted Robo-Advisor for the Modern Investor

With its commitment to low fees, globally diversified portfolios, and a data-driven approach to investment management, Indexa Capital has established itself as a trusted robo-advisor for individuals seeking a simplified and effective way to achieve their financial goals. The firm’s transparency, user-friendly platform, and consistent track record of success have made it a popular choice among investors across Europe.

Indexa Capital: A Case Study in Robo-Advising

Indexa Capital provides a compelling case study in the rise of robo-advising and its potential to revolutionize the way individuals approach investing. The firm’s success demonstrates the power of data, technology, and a focus on investor needs to provide a simplified and effective investment solution that can empower individuals to achieve their financial goals.

Indexa Capital: A Glimpse into the Future of Investing

Looking ahead, Indexa Capital is poised to play a pivotal role in shaping the future of investing. The firm’s commitment to innovation and its focus on providing a user-friendly and data-driven investment experience are likely to continue to attract investors seeking a more streamlined and effective approach to managing their financial future.

Conclusion

In conclusion, Indexa Capital has emerged as a leading force in the robo-advisory industry, offering a compelling solution for individuals seeking a low-cost, globally diversified, and data-driven approach to investing. With its commitment to simplicity, transparency, and consistent performance, Indexa Capital empowers investors to make informed financial decisions and achieve their long-term financial objectives.